SALE OF REAL ESTATE LOCATED IN FRANCE BY A SWISS RESIDENT

France applies a tax on real estate profit, which depends on the difference between the purchase value and the resale value (real estate profit). An exemption exists when the sale concerns the main residence but let us leave this assumption aside since a Swiss resident has, by definition, his main residence in Switzerland, and not in France. Cet impôt dépend de la différence entre la valeur d’acquisition et la valeur de revente (plus-value).

Il existe une exonération en cas de vente de la résidence principale, mais nous laisserons de côté cette hypothèse puisqu’un résident suisse a, par définition, sa résidence principale en Suisse, et non en France.

Here is a quick overview of the main differences and similarities between the sale of a property by a Swiss resident or a French resident:

1. Differences

- Tax rate: social contributions of a different amount

In the event of a sale, the real estate profit will be taxed as follows:

A. Taxes:

Rate: 19%

No difference for French or Swiss residents.

B. Social contributions:

Warning: judicial disputes took place regarding the imposition of payment of social contributions to Swiss residents. French law was amended on 1 and lessened the rate of social contributions to be paid by Swiss residents

However, at present, there are persisting uncertainties about the range of application of this lessened rate.

Rate:

17,2 % for French residents

7.5% for Swiss residents since 1 January 2019

C. An “additional tax” of up to 6%

in the event of a “significant real estate profit”,

i.e. over €50’000

- Tax representative

A person domiciled outside the European Union and selling real estate in France must have an accredited tax representative. This tax representative guarantees a correct payment of real estate profit tax in France. He is liable In the event of misdeclaration.

The tax representative must be accredited in advance by the tax authorities. It should be noted that some specialized companies have permanent approval.

There are two exceptions to the appointment of an accredited tax representative:

1° when the property has been held for more than 30 years;

2° when the sales price is lower than EUR 150’000.00

It should be noted that a tax representative must be appointed even if the seller records a loss on the sale…

2. Similarities

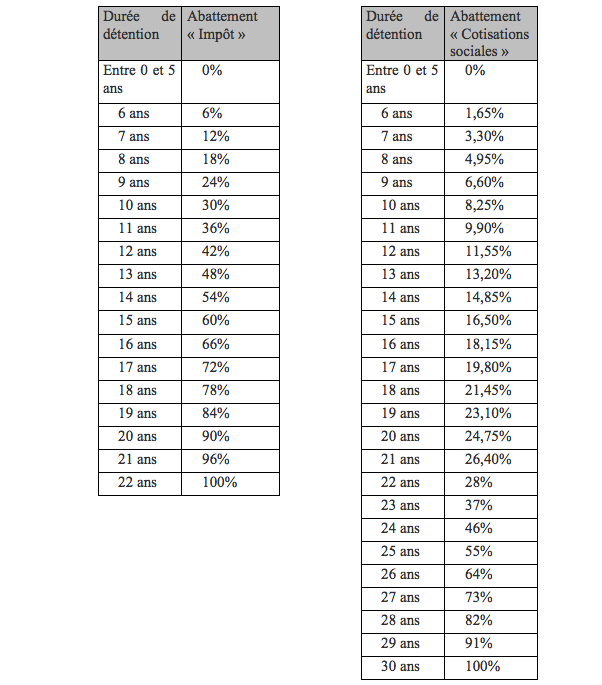

- Exemption for duration of ownership: total exemption after 30 years of ownership. French law provides for a decrease on the real estate profit based on the duration of ownership of the property: the longer the property has been held, the higher the percentage of decrease on the real estate profit will be. The tax rate is identical for a seller residing in France or in Switzerland. A different tax rate applies for the real property sale (19%) and for the “social contributions” (17.2%/7.5%).

Exemple:

Mr. A, a Swiss resident, sells his secondary residence in France on March 1st, 2019 to Mr. B, a French resident (item without impact), for EUR 500’000.00.

Purchase price (in the year 2000): EUR 300’000.00

Selling fees and costs:

EUR 67,500

Total purchase: EUR 367’500.00

Real estate capital gain: Sales price (EUR 500’000.00) – Purchase price (EUR 367’500.00) = EUR 132’500.00.

Period of ownership: 19 years.

The seller will have to pay the following taxes to the French tax authorities:

- Tax for the real estate gain capital (19%)

Decrease of 84% for a 19-year ownership period, i.e. 84% of the capital gain of EUR 132’500.00 = EUR 21’200.00.

Tax: 21’200.00 x 19% = EUR 4’028.00

- Social contributions: (7,5%)

Decrease of 23,10% for a 19-year ownership period, i.e. 23.10% of EUR 132’500.00 = EUR 101’892.50.

Tax: 101’892.50 x 7,5% = EUR 7’641.94.

Monsieur A devra payer au total un impôt de EUR 11’669.94.

Anthony Birraux, notary in Douvaine